Payoff types

The below payoff types are samples only and meant to illustrate the wide landscape of structured products available on the Belgian market as well as selected aspects of their functioning and their investment context. Conditions apply to retail investors under national distribution rules to access some of these payoff types. Where this is relevant, the payoff type is marked with a red button reading “MIFID Opt-Out Clients Only”.

The display of any of the below payoff types and related descriptions on our website does not constitute investment advice.

SAMPLE PRODUCT

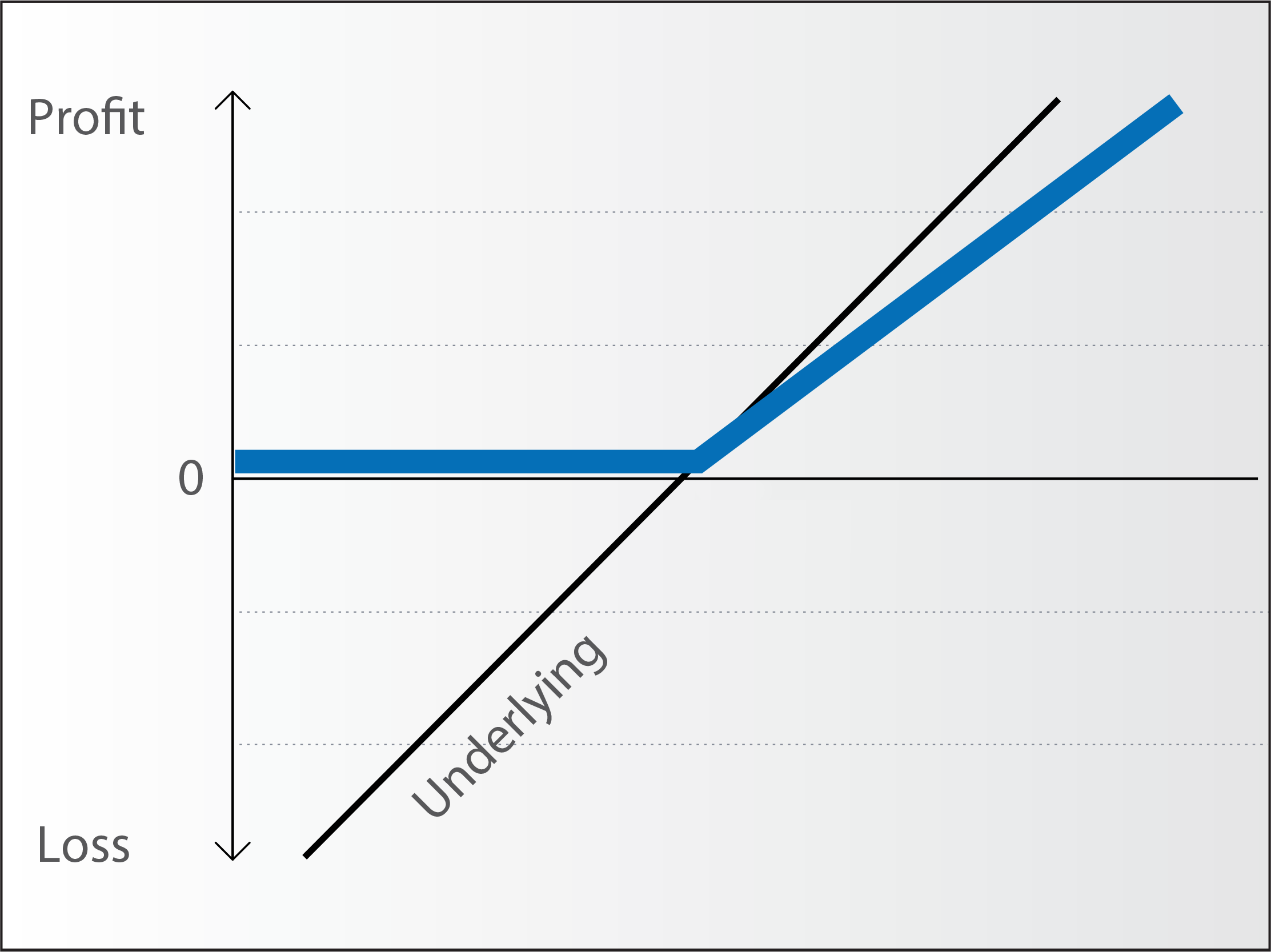

CALL PARTICIPATION

Main features:

- Minimum redemption at expiry equivalent to the capital protection

- Capital protection is defined as a percentage of the nominal (100%)

- Capital protection refers to the nominal only, and not to the purchase price

- Value of the product may fall below its capital protection during the lifetime

- Participation in a positive performance of the underlying

- Capital protection is traded in against a lower rise than any rise of the underlying

- Rising underlying expected over intended holding period

- Loss limitation needed

- Bullish Note

SAMPLE PRODUCT

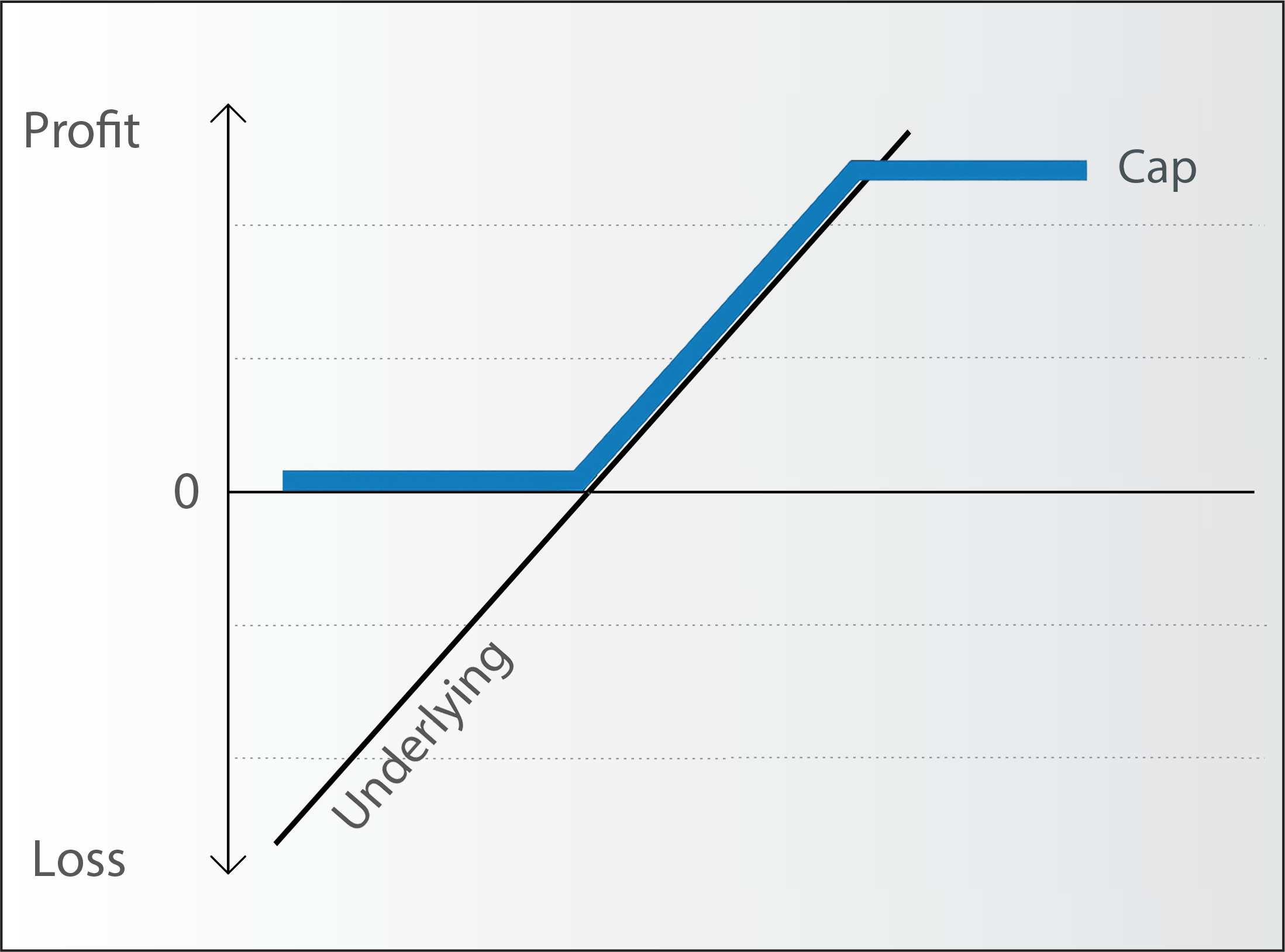

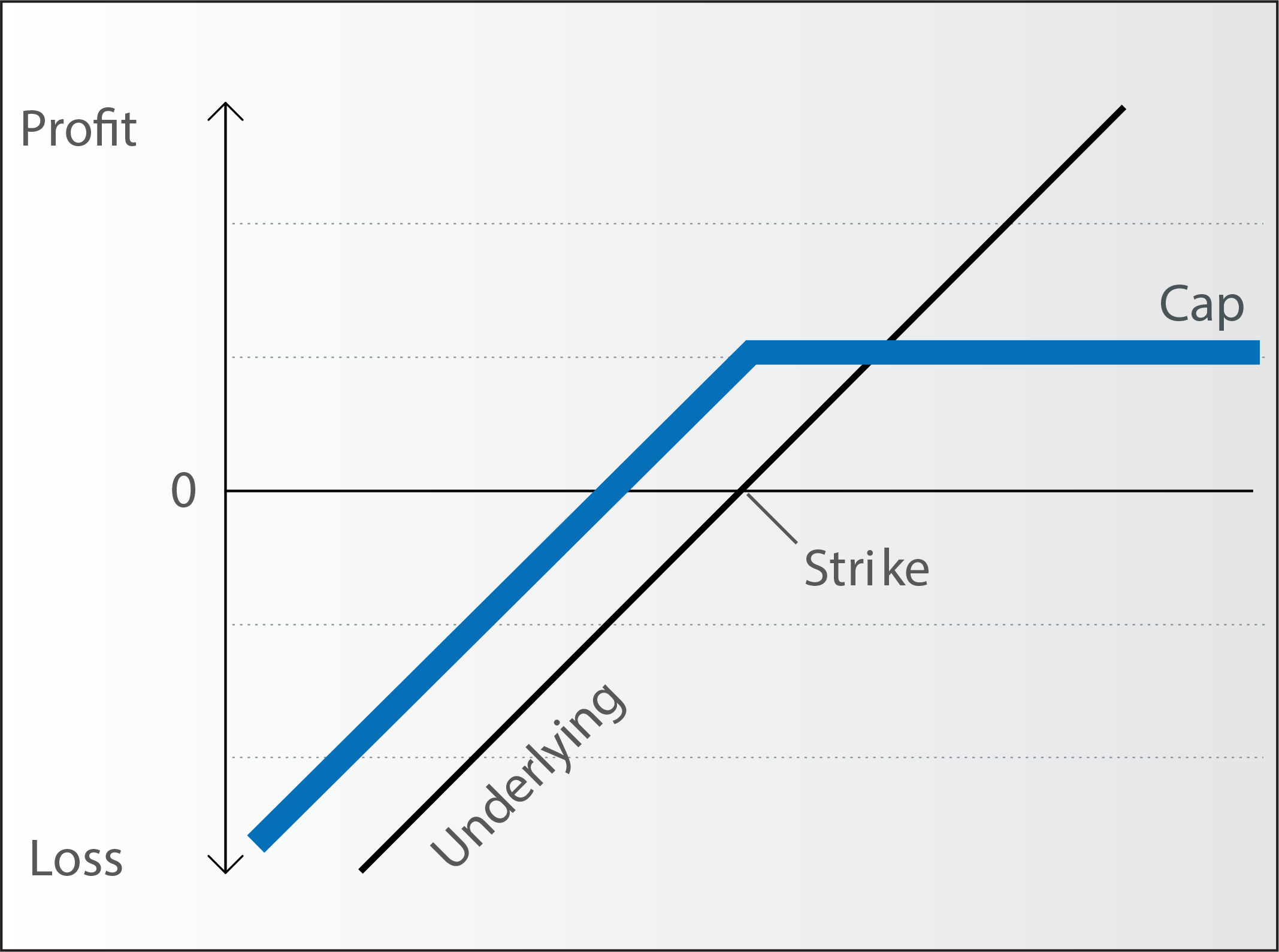

CALL SPREAD

Main features:

- Minimum redemption at expiry equivalent to the capital protection

- Capital protection is defined as a percentage of the nominal

- Capital protection refers to the nominal only, and not to the purchase price

- Value of the product may fall below its capital protection during the lifetime

- Participation in a positive performance of the underlying up to the Cap

- Limited profit potential (cap) compensated by capital protection

- Rising underlying expected over intended holding period

- Loss limitation needed

- Capped Capital Protection

SAMPLE PRODUCT

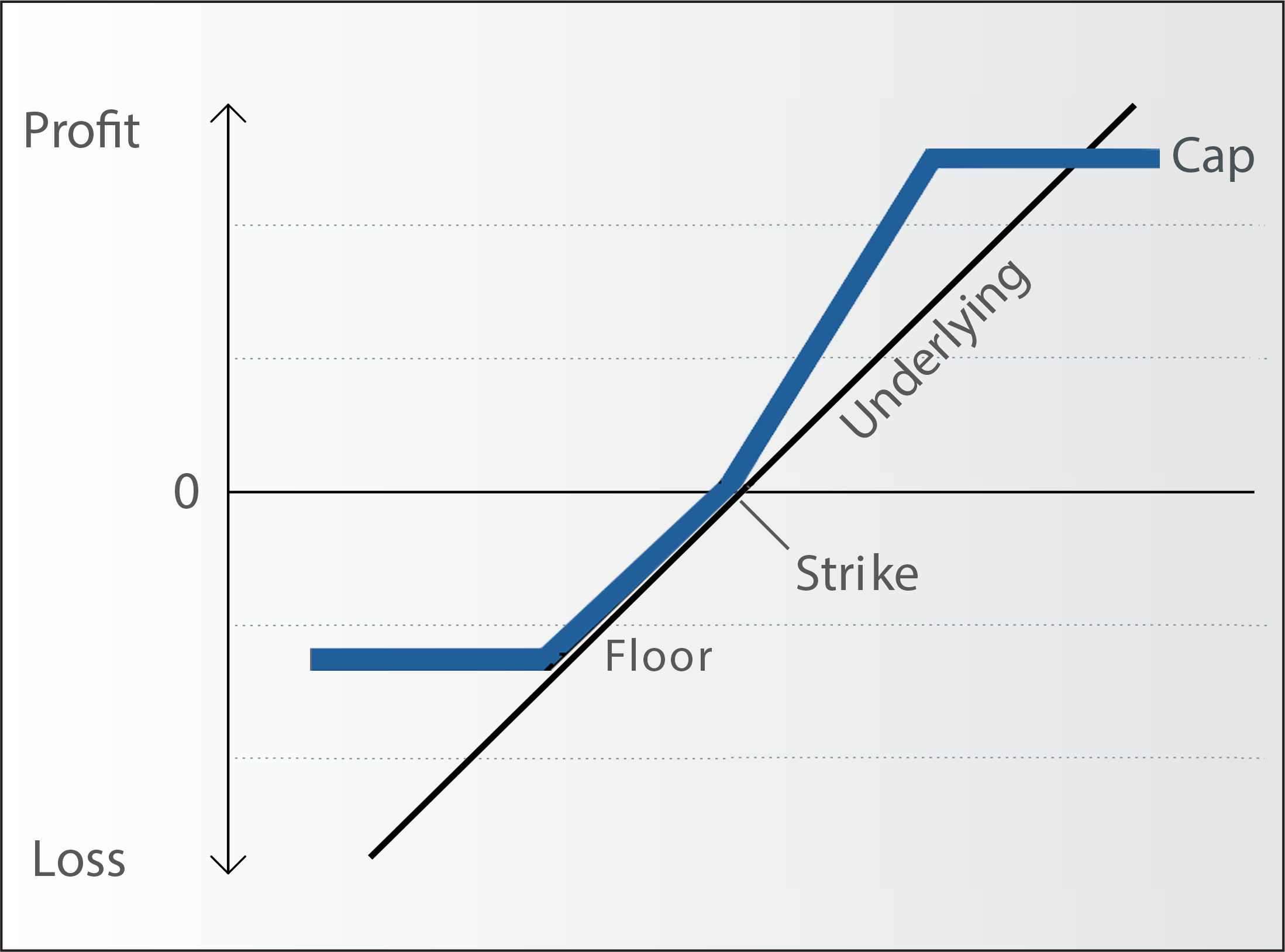

CALL-PUT SPREAD

Main features:

- Over-proportional (geared) participation up to the Cap in case of a positive performance of the underlying

- Geared participation to start at strike level

- Minimum redemption at expiry equivalent to the Floor level (limited loss or buffer)

- Capped participation compensated by floored (limited) loss and gearing

- Rising underlying expected over intended holding period

- Loss limitation needed

- Capped Capital Protection

SAMPLE PRODUCT

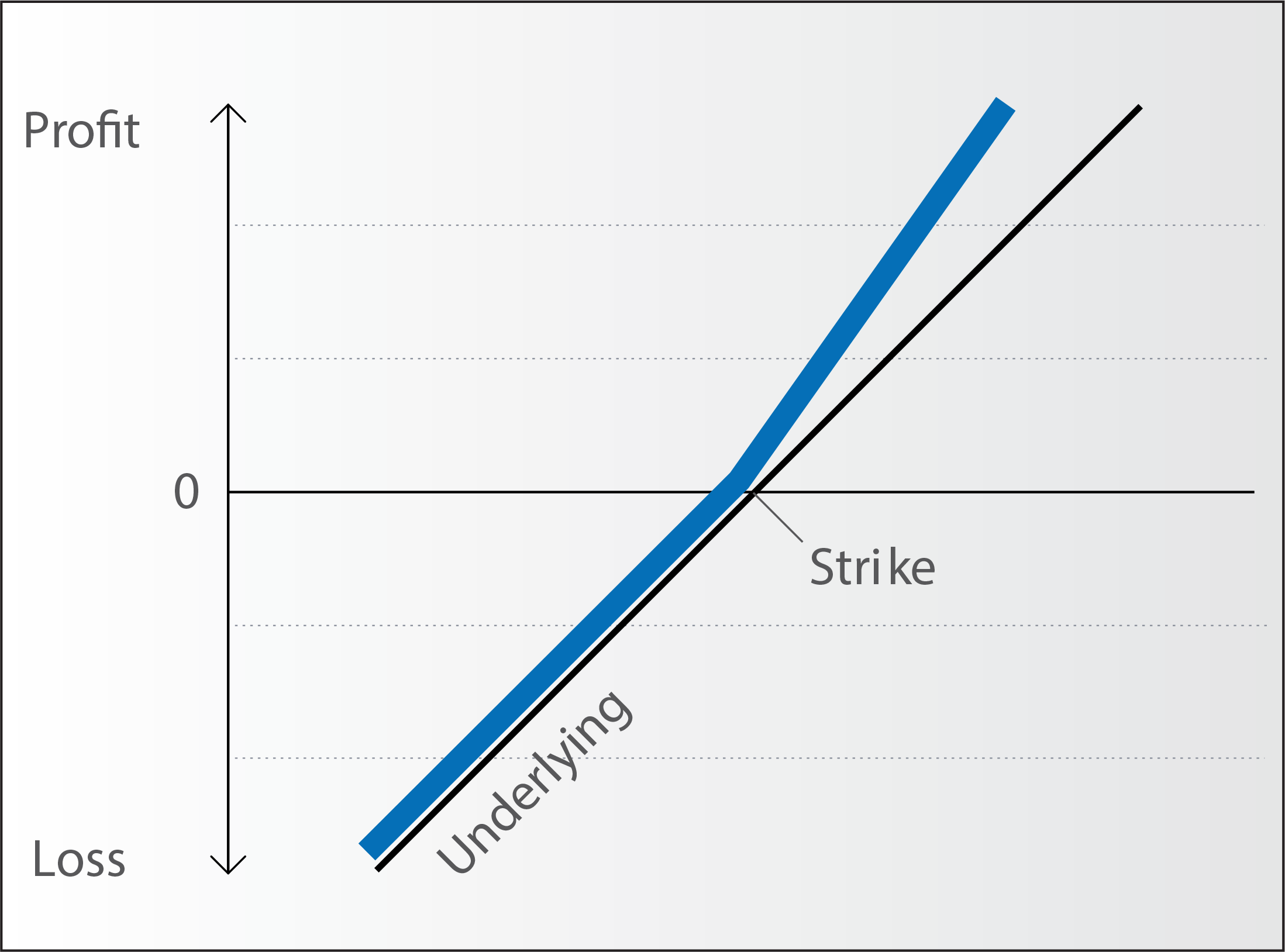

BOOSTER

Main features:

- No capital protection

- Unlimited participation in the development of the underlying

- Disproportional participation (outperformance) in a positive performance of the underlying

- Reflects underlying price evolution 1:1 when below strike

- Variations with cap exist

- Ideal for investors with bull market expectations and loss absorption capacity

- (Capped) outperformance certificate

SAMPLE PRODUCT

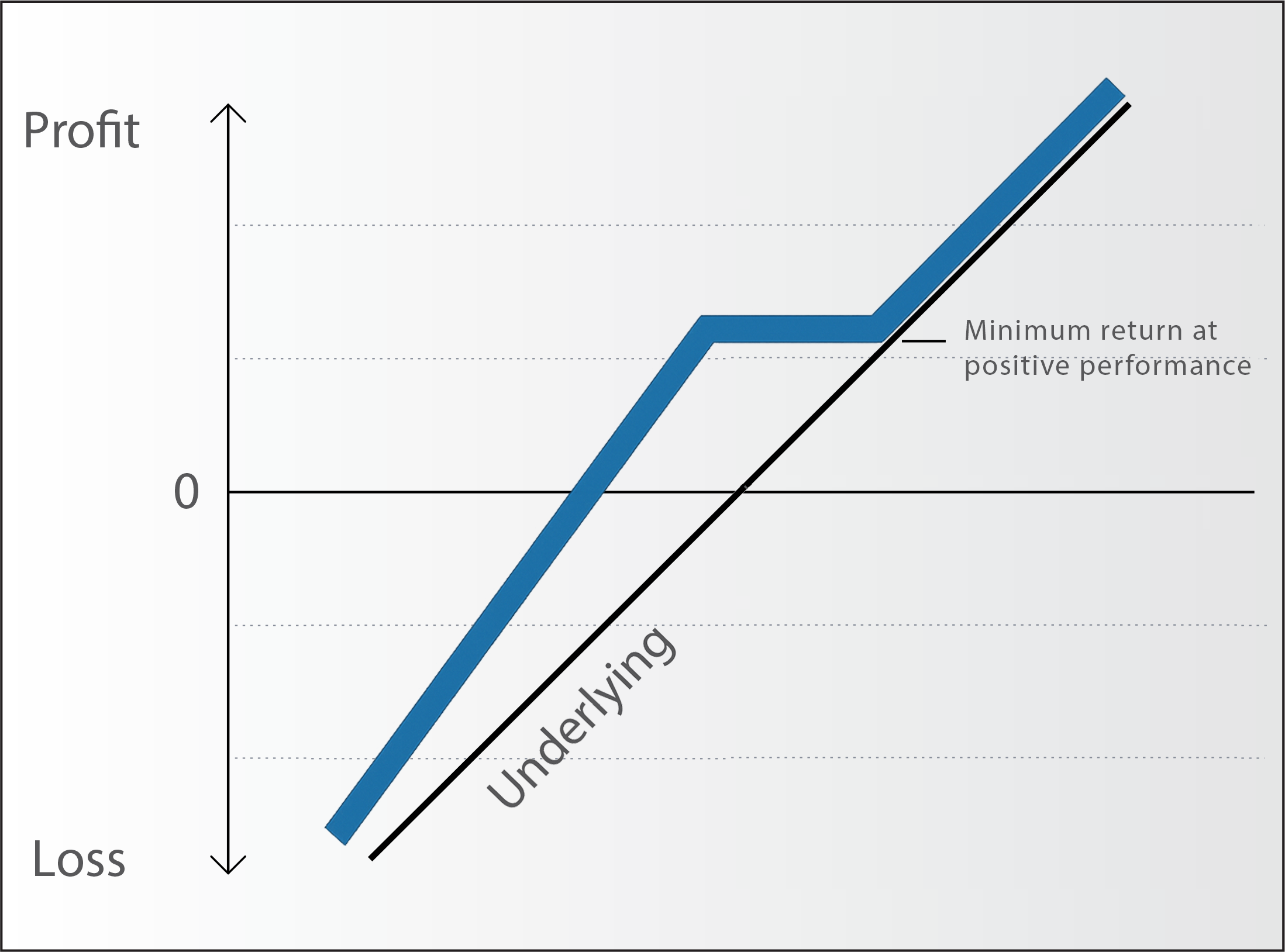

OPTIMAL

PERFORMANCE NOTE

Main features:

- When the underlying’s performance is positive, the investor receives the fixed coupon along with 100% participation in the rise of the underlying, with a minimum gain of x. (Example x= 40%)

- When the underlying’s performance is negative, the investor is protected by a buffer but can suffer a full loss.

- The buffer for negative performance is calculated in correlation with the minimum gain for positive performance. (Example: in case of a 40% minimum gain for a positive performance, the investor receives 1.4 times the underlying’s value, should the underlying, instead of rising, close at maturity below par.)

- This product is suitable for investors seeking exposure to the market upside while limiting downside risk.

- The guaranteed minimum positive performance ensures a predictable return floor in rising markets.

- The adjustment for negative performance reduces exposure to losses, offering a safety net in bear markets.

- Ideal for investors who seek market exposure with a certain volatility protection.

SAMPLE PRODUCT

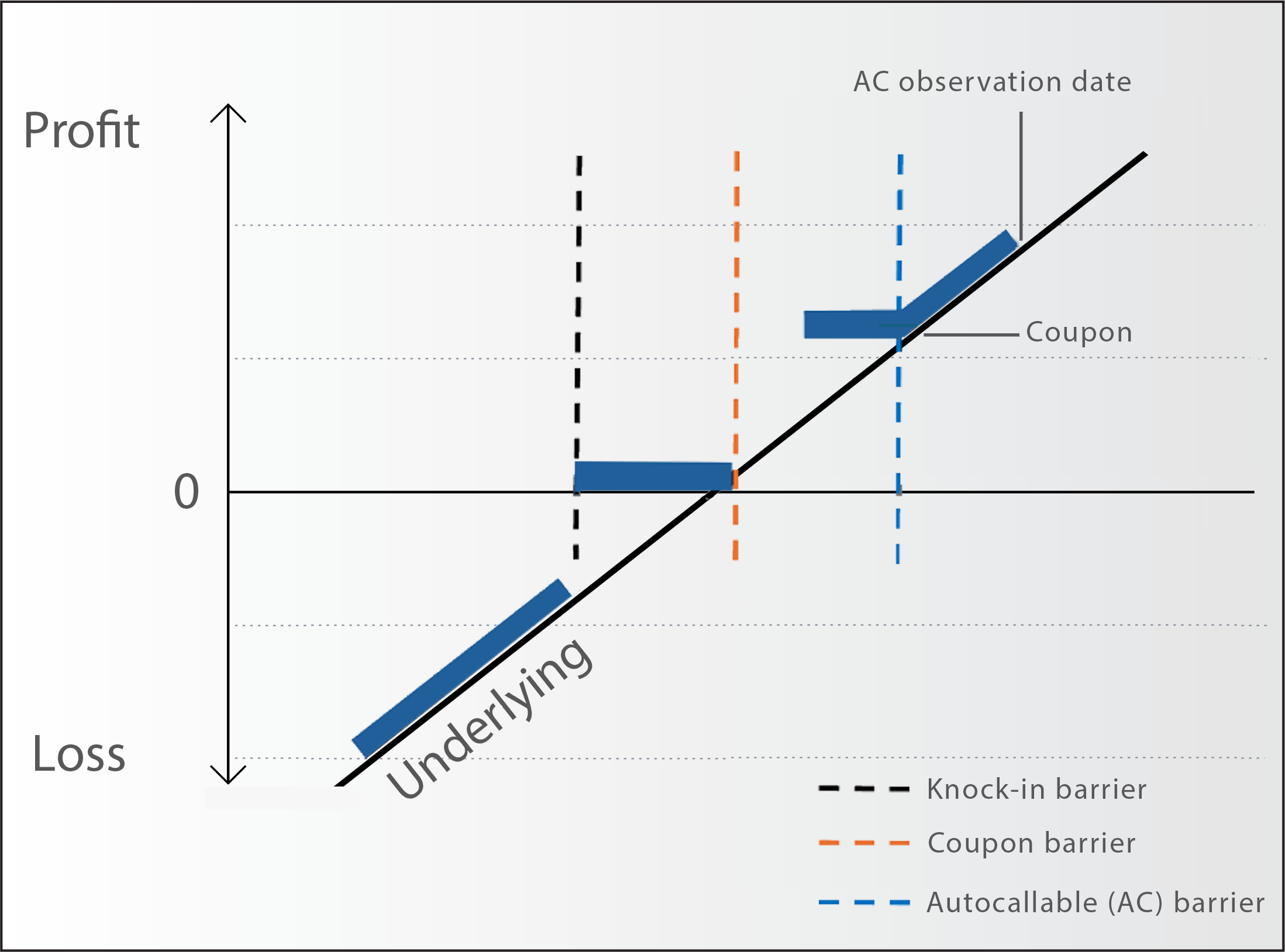

AUTOCALLABLE

Main features:

- Automatically redeems early if the underlying asset’s performance meets or exceeds a predetermined level (“auto-call” barrier) on observation dates.

- Offers periodic coupons, which are paid if the underlying price is above a specific coupon barrier on observation dates.

- Typically includes conditional capital protection, meaning the principal is protected unless the underlying breaches a predefined “knock-in barrier.“

- If not auto-called, the product matures at a fixed date, with payout determined by the underlying’s performance relative to the knock-in barrier.

- Suitable for investors seeking higher returns than traditional fixed-income investments.

- Best in moderately bullish or neutral market conditions where underlying assets are expected to stay within a certain range.

- Investors need to accept risk of loss of capital if the underlying breaches the knock-in barrier.

- Ideal for medium-term investments with defined observation periods.

SAMPLE PRODUCT

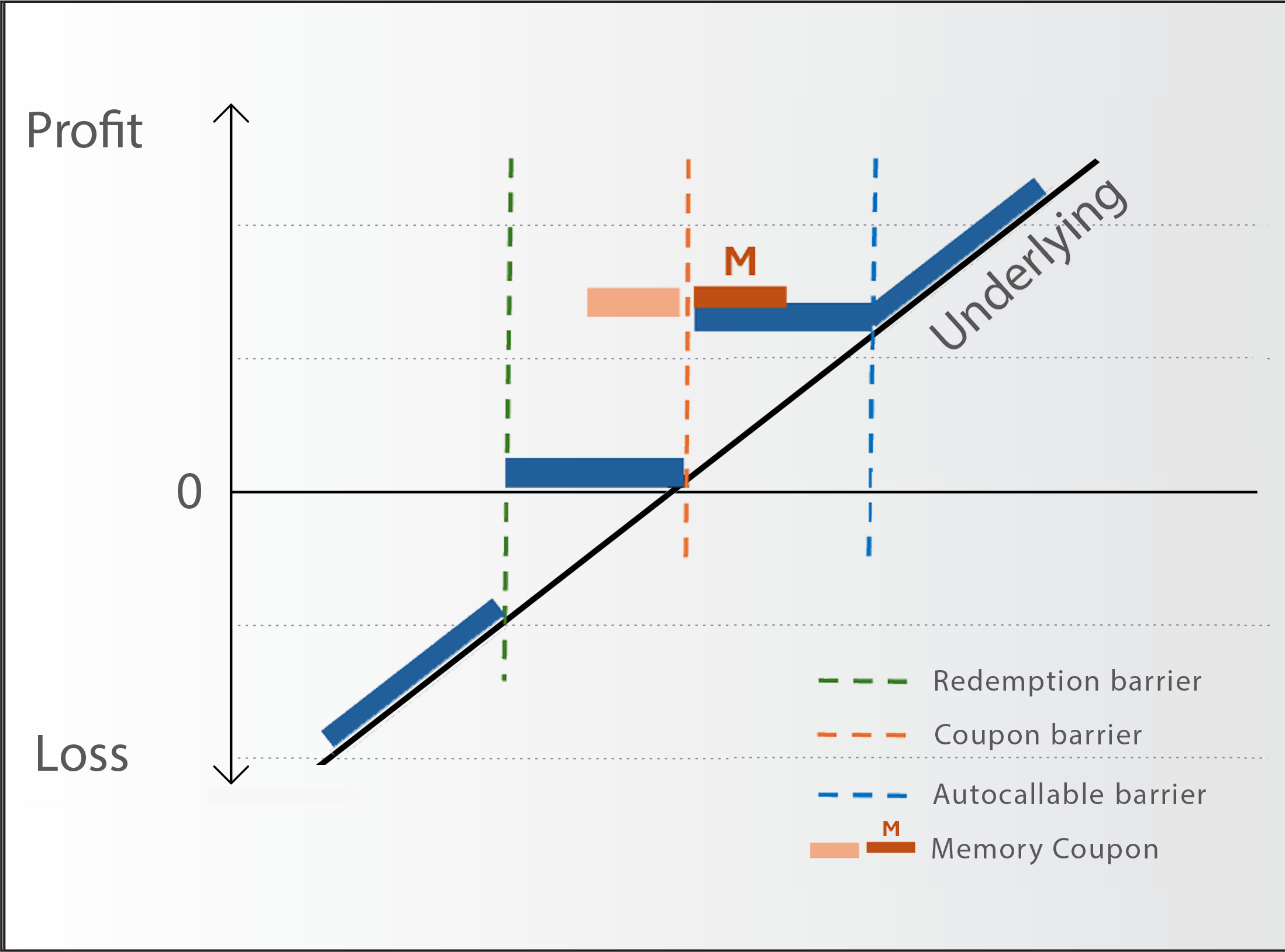

AUTOCALLABLE WITH MEMORY

Main features:

- If the underlying asset’s performance is above the Coupon Barrier Level, the investor receives the full annual coupon plus any unpaid past coupons (Memory).

- If the performance is below the Coupon Barrier, the coupon is not paid but stored in the Memory. The Memory accumulates unpaid coupons and resets to zero once a coupon is paid.

- The note is autocalled (redeemed early at par) if the underlying asset’s performance is above the Autocall Barrier Level on an observation date. If autocalled, the investor receives par value + accumulated coupons.

- If not autocalled, the investor’s redemption amount depends on the final performance of the underlying asset. If the performance at maturity is above the Redemption Barrier, the investor is redeemed at par (100% of initial investment).

- If the performance is below the Redemption Barrier, the investor receives an amount proportional to the actual performance of the underlying asset, leading to a potential loss.

- Best suited for investors seeking enhanced yield opportunities in moderately bullish or range-bound markets while accepting potential downside risk.

SAMPLE PRODUCT

REVERSE CONVERTIBLE

Main features:

- No capital protection

- Should the underlying close below the Strike at expiry, the underlying and/or a cash amount is redeemed.

- Should the underlying close at or above the Strike at expiry the nominal is paid at redemption.

- The coupon is always paid, irrespective of the underling’s price.

- Limited profit potential compensated by a coupon at prefixed level.

- Ideal for investors seeking exposure the sidewards moving markets where a direct investment in the underlying would be less interesting.

- (FR) Obligation à Coupon Réversible (OCR)

- (NL) Omgekeerde Converteerbare Obligatie

SAMPLE PRODUCT

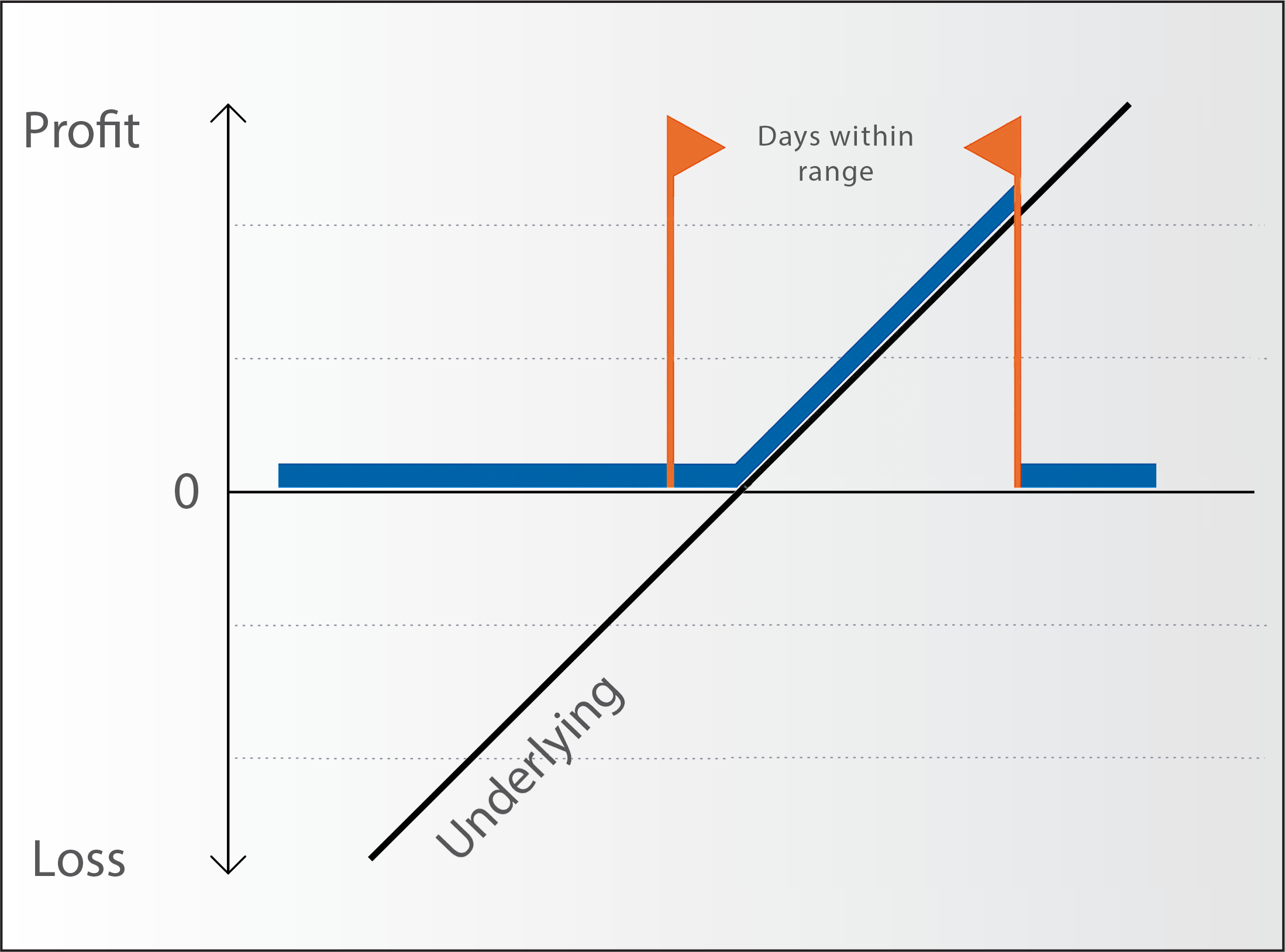

RANGE ACCRUAL

Main features:

- Fully capital-protected. The risk is limited to the loss of coupon income if the underlying moves outside the range.

- Product has a fixed income underlying (interest rate or currency pair).

- The coupon of the product is paid on condition of the underlying moving within a certain bandwidth. This is measured at fixed observation intervals, e.g. daily.

- The coupon is being calculated as “number of in-range days”, divided by the total days, multiplied with the maximum coupon for the relevant period (e.g. a month).

- Suitable when the investor expects the underlying asset to mostly trade within a defined range.

- Offers potentially higher returns than standard fixed-income products.

- Both the band width’s upper and lower levels as well as the coupon structure and observation period are customizable to reflect specific market expectations or risk appetite.

- RAN (Range Accrual Note)

- Banded Performance Note

- Step Range Note

- Stability Linked Note

SAMPLE PRODUCT

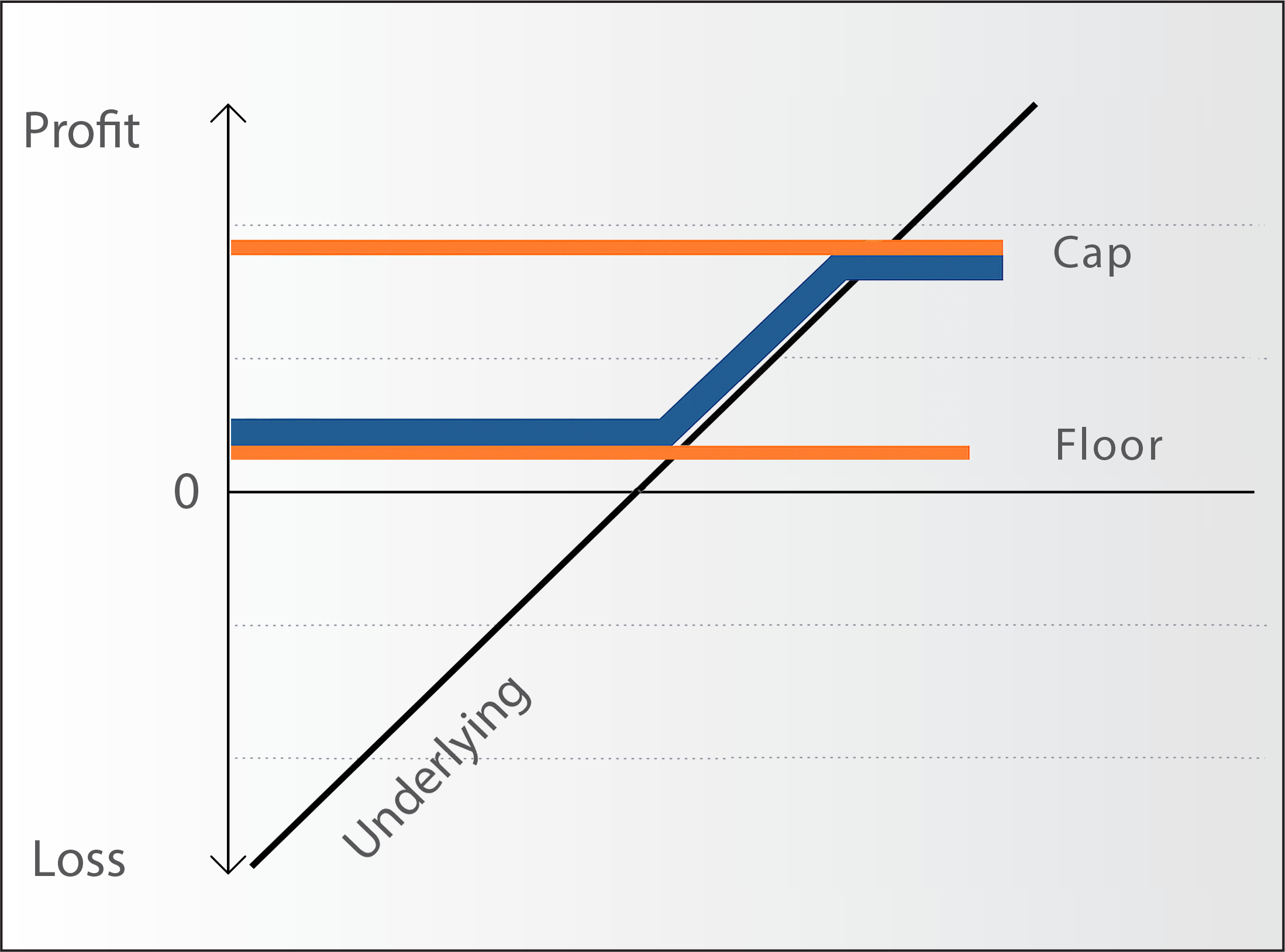

CAPPED & FLOORED FLOATER

Main features:

- Fully capital-protected.

- Product has a fixed income underlying (interest rate or currency pair).

- The investor receives as a minimum coupon the floored interest rate, as a maximum whatever is lower, the rate level of the underlying at the end of maturity or the capped interest rate.

- Product is designed for investors seeking predictable returns within a controlled risk-reward framework while still participating in interest rate variability.

- This product guarantees the return of the principal at maturity, making it also suitable for conservative investors.

- Investors benefit from floating rate exposure linked to EURIBOR or CMS, allowing them to capitalize on specific interest rate movements.

- Medium to long term investment horizon

- Collared Floater

- Banded Floater

- (Interest) Corridor Note